Fees for their services can vary quite a bit, so be sure to shop around when you’re ready to hire an accounting professional. To get a more accurate picture of professional accounting costs, set up a free consultation with an accounting professional. Before doing that, however, let’s break down the various pricing structures and services available for professional financial accounting services.

Get live expertise

Information Technology Management Essentials includes topics such as information systems analysis, database resource management, spreadsheet literacy, and computer literacy concepts. This course will help students understand the importance of information technology in an organization and apply databases to solve business problems. Business management graduates report an average salary increase of $6,469 after completing their degree at Western Governors University.

Accounting cost by service

Knowing how much to charge for your consulting fees is just half the battle. Now, it’s time to learn how to communicate your prices with clarity and confidence. The tips above paired with the processes below should help you settle on what to charge for your consulting services and formulate a consulting business price guide. Feel free to look at consulting rates by industry, but don’t use them as your bible to pricing—use them as another data point to reference. Yet, setting your consulting rates doesn’t need to be an anxiety-inducing experience that keeps you up at night. Done right, it should be a downright rewarding experience for both you and the client.

Factors Influencing Accounting Fees

Laura is a freelance writer specializing in small business, ecommerce and lifestyle content. As a small business owner, she is passionate about supporting other entrepreneurs and sharing information that will help them thrive. If your small business doesn’t include piles of paperwork and boxes full of receipts, you may want to consider handling your accounting yourself. There’s no shortage of excellent, affordable software options on the market and we’ve done the legwork to research the top choices for you. Check out our reviews of the Best Accounting Software to find one that will work for your needs.

QuickBooks Online Self-Employed plan

High hedging costs often make this financing unaffordable to many of the least-developed countries and raises questions of debt sustainability. More attention is needed from DFIs to focus interventions on project de-risking that can mobilise much higher multiples of private capital. The NZE Scenario sees a major rebalancing of investments https://www.business-accounting.net/how-to-calculate-commission-how-to-calculate-a/ in fuel supply, away from fossil fuels and towards low-emissions fuels, such as bioenergy and low-emissions hydrogen, as well as CCUS. However, global spare oil production capacity is already close to 6 million barrels per day (excluding Iran and Russia) and there is a shift expected in the coming years towards a buyers’ market for LNG.

Business Tax Tips

- This course will help students understand the importance of information technology in an organization and apply databases to solve business problems.

- Finding the balance between time and money spent on your books will help you keep accounting costs on track.

- Calculate how much an accountant will cost your business compared to using accounting software.

- Competency-based education means you can move as quickly through your degree as you can master the material.

Emotional and Cultural Intelligence focuses on key personal awareness skills that businesses request when hiring personnel. Students will increase their skills in written, verbal, and nonverbal communication skills. The course then looks at three areas of personal awareness including emotional intelligence (EI), cultural awareness, and ethical self-awareness – building on previously acquired competencies and adding new ones. This course helps start students on a road of self-discovery, cultivating awareness to improve both as a business professional and personally. That 40% markup would cover the cost of your expertise and business expenses like overhead, benefits, taxes, and more. These costs are different for everyone, depending on tax status and type of business.

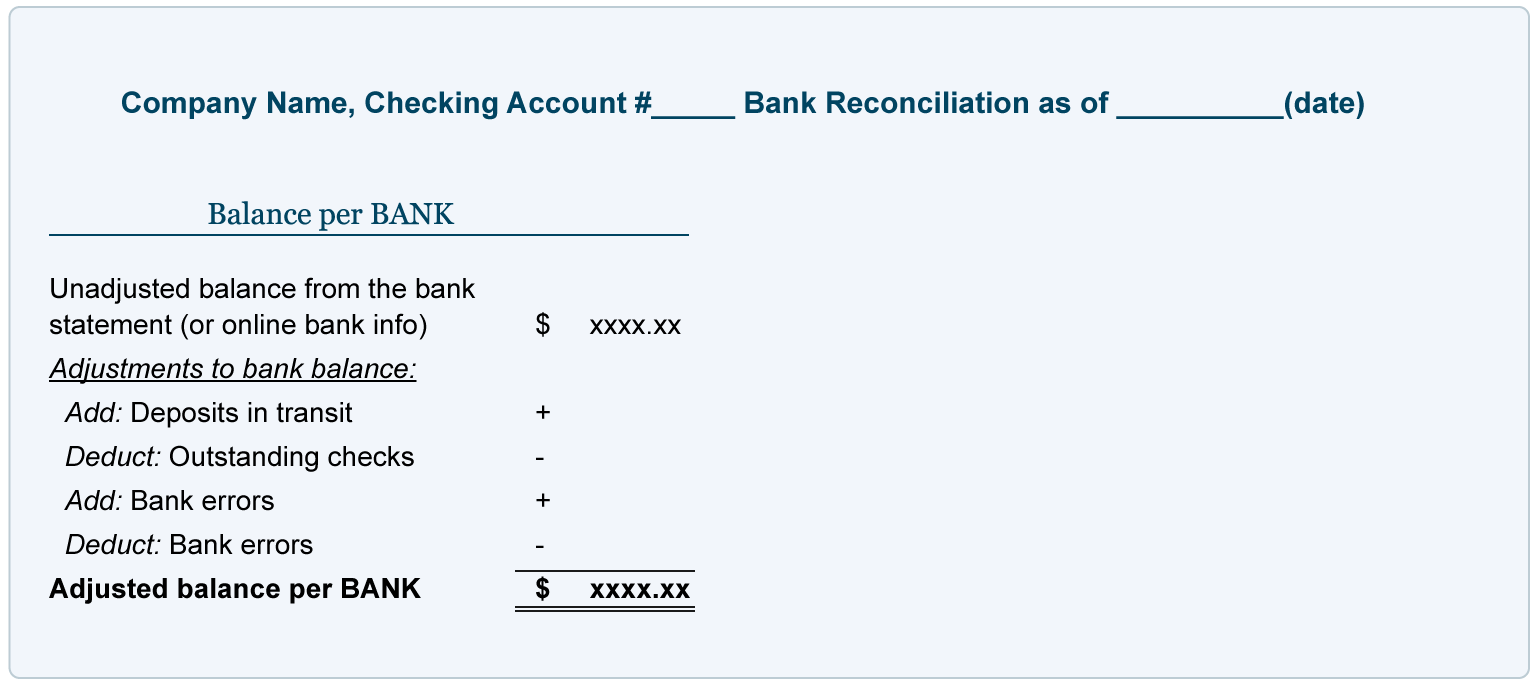

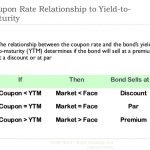

Topics covered include budgeting, cost-volume-profit analysis, job costing, process costing, activity-based costing, standard costing, and differential analysis. Prerequisites include Principles of Accounting and Financial Accounting. Financial Accounting focuses on ways in which accounting principles are used in business operations. Students learn the basics of financial accounting, including how the accounting cycle is used to record business transactions under generally accepted accounting principles (GAAP). Students will also be introduced to the concepts of assets, liabilities, and equity. This course also presents bank reconciliation methods, balance sheets, and business ethics.

While larger companies often keep accountants on staff, small businesses typically contract with an accounting firm or independent accountant who offers the services they need. Hiring an accountant for tax preparation can be a cost-effective choice for those who have complex taxes, own a business, or need assistance in identifying tax deductions and credits. An experienced tax professional can help navigate tax laws and potentially save money on taxes, making their fee worthwhile.

An in-house accountant could work part or full time – depending on your requirements – meaning they’d be added to your payroll and paid a salary. For others, outsourcing an accountant and inventory management in 2021 working with them as needed – often paying per hour – can be more cost-effective. According to one small business report, 71% of small businesses outsource at least one accounting task4.

For many businesses, a good accountant or tax consultant is often indispensable, as people don’t want to get into the nitty-gritty of tax returns and tax laws – and for good reason. These are often time consuming and getting these things wrong can end you up in hot water. This article will take a look at what an accountant can do for your business, and how much one should cost and why. Although doing your taxes independently using tax software can save you money versus hiring a professional, working with a CPA has many benefits. Accountants prepare tax returns with much more sophisticated software compared to the software sold to consumers.

With a master’s degree in accounting and as a certified public accountant, you may find you’re more qualified for leadership positions and senior-level roles. These include accounting manager, auditor, investment banker, and chief financial officer. Businesses need professionals who can help manage their finances and help everything run smoothly with budgets and taxes. This online degree from WGU prepares you for a lucrative and successful career as an accountant in whatever field or specialty you’re passionate about. You can also be prepared to sit for the accounting certification exam and become a certified public accountant.

By filing by the deadline, taxpayers avoid failure to file penalties – even if they’re unable to pay. For those who owe federal taxes, the IRS has a number of payment options available. Taxpayers who have filed and paid on time and have not been assessed any penalties for the past three years often qualify to have the penalty abated. A taxpayer who does not qualify for this relief may still qualify for penalty relief if their failure to file or pay on time was due to reasonable cause and not willful neglect. However, taxpayers can limit late-payment penalties and interest charges by paying their tax electronically.

These properties will be used to solve problems related to your major and make sense of everyday living problems. Students should complete Applied Probability and Statistics or its equivalent prior to engaging in Applied Algebra. He’s spent almost a decade writing about startup, marketing, and entrepreneurship topics, having built and sold his own post-apocalyptic https://www.personal-accounting.org/ fitness bootstrapped business. A writer by day and a peak bagger by night (and early early morning), you can usually find Jesse preparing for the apocalypse on a precipitous peak somewhere in the Rocky Mountains of Colorado. So, remember that how much you charge for consulting trickles down to what makes your business run and remain profitable and secure.