When you divide your net income by your sales, you’ll get your business’s profit margin. Your profit margin reports the net income earned on each dollar of sales. A high profit margin indicates a very healthy company, while a low profit margin could suggest that the business does not handle expenses well. By subtracting your revenue from your expenses, you can calculate your net income. This is the money that you have earned at the end of the day. It’s possible that this number will demonstrate a net loss when your business is in its early stages.

Shareholders, or owners of the stock, benefit from limited liability because they are not personally liable for any kind of debts or obligations the corporate entity may have as a business. However, each partner generally has unlimited personal liability for any kind of obligation for the business (for example, debts and accidents). Some common partnerships include doctor’s offices, boutique investment banks, and small legal firms. A high debt-to-equity ratio illustrates that a high proportion of your company’s financing comes from issuing debt, rather than issuing Inventory to shareholders. Suppose you’re attempting to secure more financing or looking for investors. In that case, a high debt-to-equity ratio might make it more difficult to find creditors or investors willing to provide funds for your company.

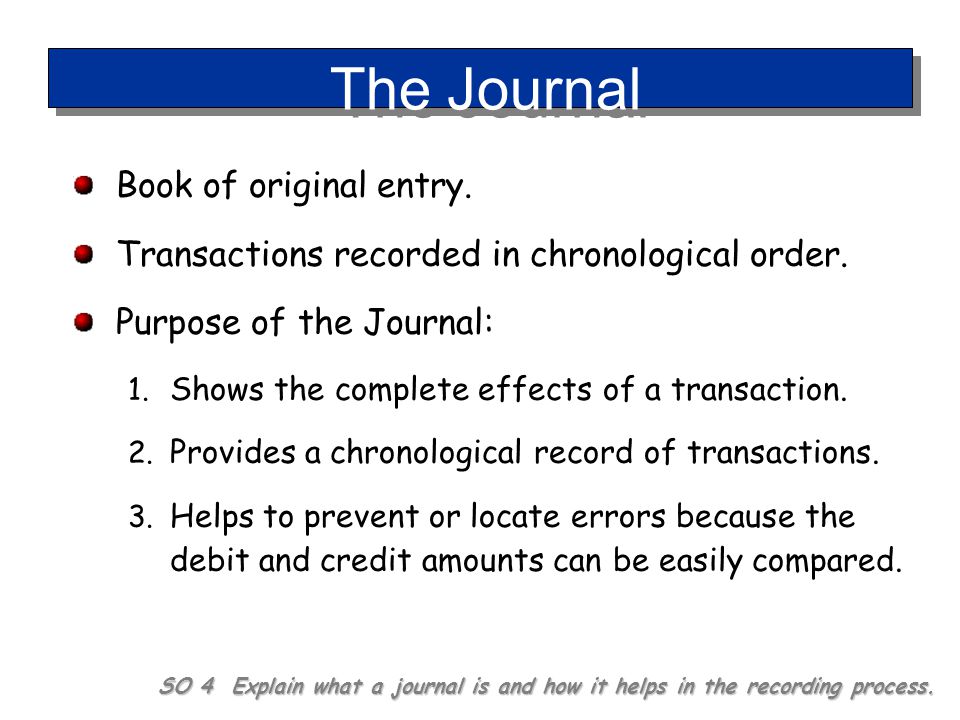

Each entry on the debit side must have a corresponding entry on the credit side (and vice versa), which ensures the accounting equation remains true. Under the double-entry accounting system, each recorded financial botkeeper vs veryfi transaction results in adjustments to a minimum of two different accounts. A company’s “uses” of capital (i.e. the purchase of its assets) should be equivalent to its “sources” of capital (i.e. debt, equity).

- So that will be your equity investment and become an asset for the company.

- As this is not really an expense of the business, Anushka is effectively being paid amounts owed to her as the owner of the business (drawings).

- That’s the case for each business transaction and journal entry.

- Let us take the example of an equipment purchase that has been funded by a mix of available cash and bank loan.

- Its applications in accountancy and economics are thus diverse.

Because the Alphabet, Inc. calculation shows that the basic accounting equation is in balance, it’s correct. Due within the year, current liabilities on a balance sheet include accounts payable, wages or payroll payable and taxes payable. Long-term liabilities are https://www.wave-accounting.net/ usually owed to lending institutions and include notes payable and possibly unearned revenue. If a company’s assets were hypothetically liquidated (i.e. the difference between assets and liabilities), the remaining value is the shareholders’ equity account.

What are Specific Names for Equity on the Balance Sheet?

Since the balance sheet is founded on the principles of the accounting equation, this equation can also be said to be responsible for estimating the net worth of an entire company. The fundamental components of the accounting equation include the calculation of both company holdings and company debts; thus, it allows owners to gauge the total value of a firm’s assets. The accounting equation is based on the premise that the sum of a company’s assets is equal to its total liabilities and shareholders’ equity. As a core concept in modern accounting, this provides the basis for keeping a company’s books balanced across a given accounting cycle. The accounting equation helps to assess whether the business transactions carried out by the company are being accurately reflected in its books and accounts. Shareholder Equity is equal to a business’s total assets minus its total liabilities.

Sign up for the Dummies Beta Program to try Dummies’ newest way to learn.

The accounting balance sheet formula makes sure your balance sheet stays balanced. The accounting equation uses total assets, total liabilities, and total equity in the calculation. This formula differs from working capital, based on current assets and current liabilities. The income and retained earnings of the accounting equation is also an essential component in computing, understanding, and analyzing a firm’s income statement.

For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts. For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability. The general rule of this equation is that the company’s Total assets will always be equal to the sum of its Total liabilities and Total Equity. So this Accounting Equation ensures that the balance sheet always remains ” “balanced,”” and any debit entry in the system should have a corresponding credit entry. Anushka will record revenue (income) of $400 for the sale made.

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. Apple pays for rent ($600) and utilities ($200) expenses for a total of $800 in cash. Nabil invests $10,000 cash in Apple in exchange for $10,000 of common stock.

If you’re interested in preparing to pursue a career in accounting, then DeVry can help you get started. The working capital formula is Current Assets – Current Liabilities. Not all companies will pay dividends, repurchase shares, or have accumulated other comprehensive income or loss. Double-entry bookkeeping started being used by merchants in Italy as a manual system during the 14th century. If you want to know more about accounting errors and how to spot them, we recommend reading Common Accounting Errors – A Practical Guide With Examples.

It’s the accountants’ responsibilities to keep an accurate journal of these transactions. Every transaction’s impact to Assets must have either offsetting impact to Assets or matching impact to Liabilities and Equity. The Accounting Equation is a vital formula to understand and consider when it comes to the financial health of your business. The accounting equation is a factor in almost every aspect of your business accounting.

Statement of cash flows formula

This list is not comprehensive, but it should cover the items you’ll use most often as you practice solving various accounting problems. This transaction affects both sides of the accounting equation; both the left and right sides of the equation increase by +$250. For example, if a company becomes bankrupt, its assets are sold and these funds are used to settle its debts first.

Assets that are likely to be converted into cash or probably consumed or exhausted within a financial year are termed as current assets. Naturally, the data relating to accounting is represented in numbers, and deriving the right conclusion from an interpretation requires the proper use of the accounting formula. You should note that these formulas are the foundations of accounting. To build a stronghold on accounting and indulge in higher studies relating to accounts, you need to grasp the methods right from their grassroots.

This includes expense reports, cash flow and salary and company investments. As you can see, no matter what the transaction is, the accounting equation will always balance because each transaction has a dual aspect. Liabilities are considered to be anything that is a claim against the company’s assets, such as accounts payable or other debts that the company owes.

If both ledgers of your balance sheet don’t match, there may be an error. Although the balance sheet always balances out, the accounting equation can’t tell investors how well a company is performing. If a business buys raw materials and pays in cash, it will result in an increase in the company’s inventory (an asset) while reducing cash capital (another asset). Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting.

Equity Component of the Accounting Equation

Double-entry accounting is a system where every transaction affects at least two accounts. Therefore, it can be seen that the above transaction impacts both sides of the balance sheet. The increase in machinery accounts is partly offset by a cash account decrease, while bank loan funds the remaining. Another limitation of the Accounting Equation is that it can’t tell you if the company’s records are accurately recorded. A balanced Accounting Equation by itself is insufficient to certify the accuracy of a company’s records.

Metro Corporation collected a total of $5,000 on account from clients who owned money for services previously billed. The global adherence to the double-entry accounting system makes the account keeping and tallying processes more standardized and more fool-proof. Debt is a liability, whether it is a long-term loan or a bill that is due to be paid. The major and often largest value assets of most companies are that company’s machinery, buildings, and property.

Income and expenses relate to the entity’s financial performance. Individual transactions which result in income and expenses being recorded will ultimately result in a profit or loss for the period. The term capital includes the capital introduced by the business owner plus or minus any profits or losses made by the business.